Las Vegas Sands (NYSE: LVS) fell on Tuesday following a downgrade due to the belief that a lot of the favorable news from Macau is already reflected in the stock's price.

The gaming stock declined 3.99% on trading volume roughly 50% higher than the daily average after Morgan Stanley analyst Stephen Grambing downgraded his rating to “equal-weight” from “overweight” and reduced his 12-month price target to $51 from $54. That suggests a potential gain of 13.3% from Tuesday’s closing price of $45. Grambing recognized that Sands’ shares are priced lower based on the enterprise value compared to earnings before interest, taxes, depreciation, and amortization (EV/EBITDA).

"After the outperformance YTD, the stock trades at ~11.5x/~10.5x MS 2025e/2026e EV/EBITDA, still below its pre-pandemic average of ~13.5x NTM EV/EBITDA,” he observed.

Although the stock trailed the S&P 500 last year, it experienced slight gains, leading some investors to wonder if Sands might see improved performance in 2025. That may turn out to be correct, yet the stock has begun 2025 in a chaotic manner, losing 11.64% over the last week, contributing to a 12.38% decline since the year's onset.

The optimism linked to Sands and other Macau casino shares is based on the fact that in 2024, gross gaming revenue (GGR) increased in the Chinese region, yet still falls significantly short of the figures observed prior to the coronavirus outbreak.

This suggests potential for growth and led analysts to predict that this year will see GGR rises, with 2026 expected to match or exceed pre-pandemic levels. Sands is set to benefit from these trends with the new room offerings at the Londoner and Venetian, yet Grambling contends that these elements are reflected in the stock prices.

“From a fundamental perspective, 2024 ended lower than forecasts on the back of a slower ramp in the market and greater disruption from renovations (Londoner and Venetian arena). While renovation disruption should ultimately unwind, 2025/2026 consensus estimates appear to already embed that outcome with healthy overall growth, anticipating solid share gains,” adds the analyst.

Renovations at the Londoner are anticipated to be completed in the initial half of this year, and although this may favor Sands, the operator's reliance on mass-market customers could render the stock somewhat reliant on China introducing additional, broader monetary stimulus – an outcome that isn't assured.

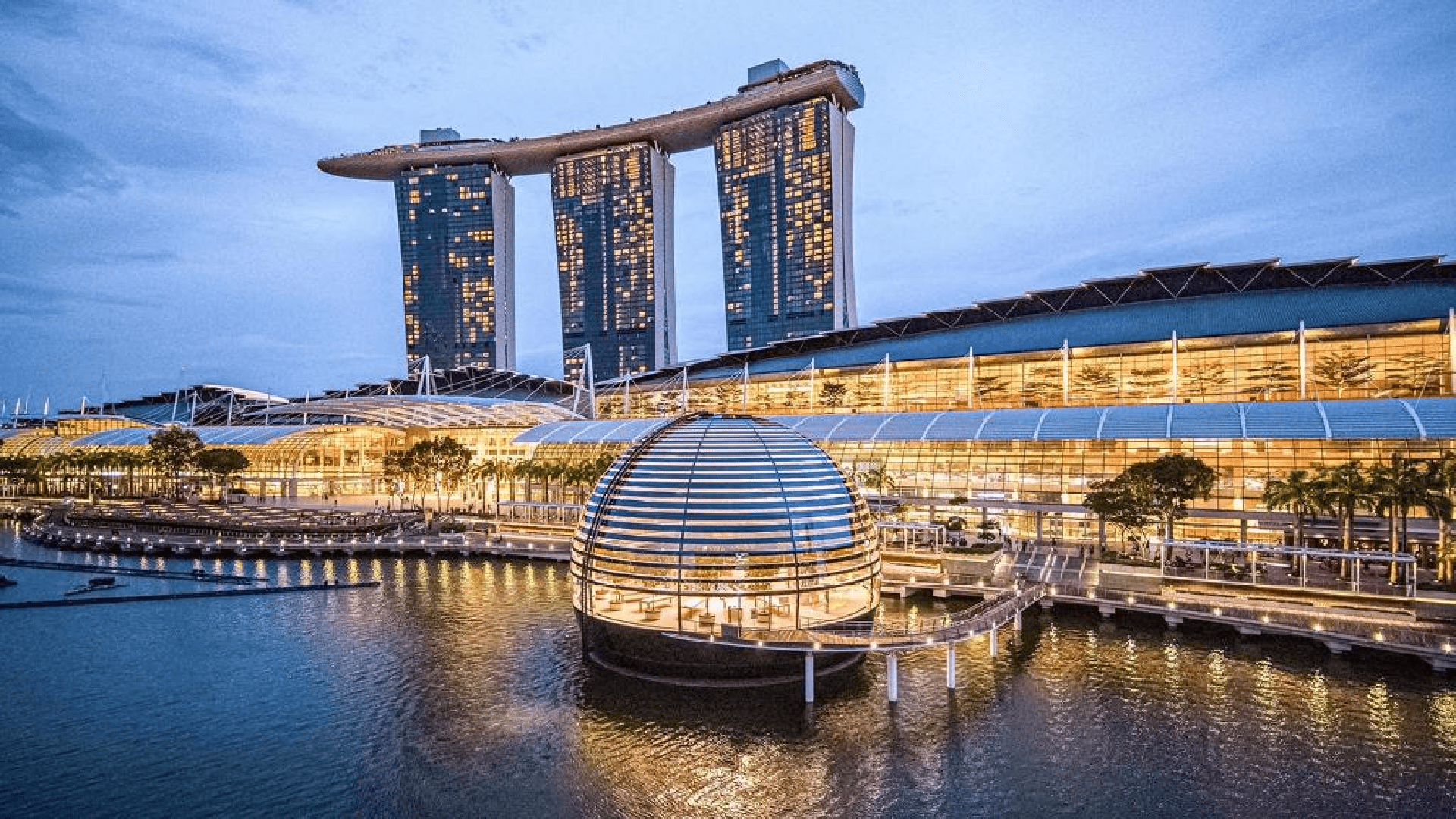

Singapore, where Marina Bay Sands is located, is the sole other market for LVS's casino hotels, and Grambling expressed a measured sentiment regarding that area as well. He noted that visits to the city-state by Chinese tourists — an essential group — are declining while Sands is preparing significant enhancements to its integrated resort there.

There are rumors that Sands might secure up to $9 billion to construct a fourth tower and make other improvements to its famous property in Singapore. Marina Bay Sands ranks among the top gaming brands globally, and its gaming facility is one of the most lucrative of its type.

Such expenses may face medium-term examination from analysts and investors if tourism in Singapore declines.

Each and every review is helpful. You can learn from even unfavorable reviews because they shed light on the overall gaming experience. Good reviews are concise and give enough details to prevent prospective players from having to make assumptions about the experience. We want to ensure that it is as error-free as possible and that it provides comments and suggestions without disparaging the company.

Our team of experts has examined and tested every website that made the short list. Find out more to see which are the best online casinos for you!

We make sure to list the most important benefits and disadvantages.

We research FAQ so that you don't have to.

We put the most important information for you in our reviews.